Things about Estate Planning Attorney

Things about Estate Planning Attorney

Blog Article

The Ultimate Guide To Estate Planning Attorney

Table of ContentsThe smart Trick of Estate Planning Attorney That Nobody is Talking AboutGetting My Estate Planning Attorney To WorkEstate Planning Attorney Things To Know Before You BuyFascination About Estate Planning Attorney

Estate planning is an activity strategy you can use to determine what occurs to your properties and obligations while you live and after you die. A will, on the other hand, is a legal file that lays out how assets are distributed, who takes care of children and family pets, and any kind of various other desires after you die.

Claims that are declined by the administrator can be taken to court where a probate court will certainly have the last say as to whether or not the case is valid.

Not known Facts About Estate Planning Attorney

After the supply of the estate has actually been taken, the value of possessions determined, and taxes and debt paid off, the executor will certainly after that seek authorization from the court to distribute whatever is left of the estate to the recipients. Any kind of estate taxes that are pending will certainly come due within 9 months of the day of fatality.

Each private areas their assets in the depend on and names someone besides their partner as the recipient. A-B trusts have actually come to be much less prominent as the estate tax exemption functions well for the majority of estates. Grandparents might move possessions to an entity, such as a 529 plan, to sustain grandchildrens' site link education and learning.

Rumored Buzz on Estate Planning Attorney

Estate coordinators can deal with the contributor in order to reduce taxed income as a result visit this page of those payments or formulate approaches that make the most of the result of those donations. This is an additional technique that can be made use of to limit fatality taxes. It includes a specific locking in the existing value, and hence tax obligation, of their building, while associating the worth of future growth of that resources to another individual. This approach involves cold the value of a possession at its worth on the day of transfer. Appropriately, the amount of potential funding gain at death is likewise iced up, allowing the estate coordinator to approximate their prospective tax obligation obligation upon fatality and far better plan for the repayment of revenue taxes.

If adequate insurance policy earnings are readily available and the policies are appropriately structured, any kind of income tax on the considered personalities of assets complying with the death of a person can be paid without resorting to the sale of properties. Proceeds from life insurance policy that are gotten by the recipients upon the death of the guaranteed are generally earnings tax-free.

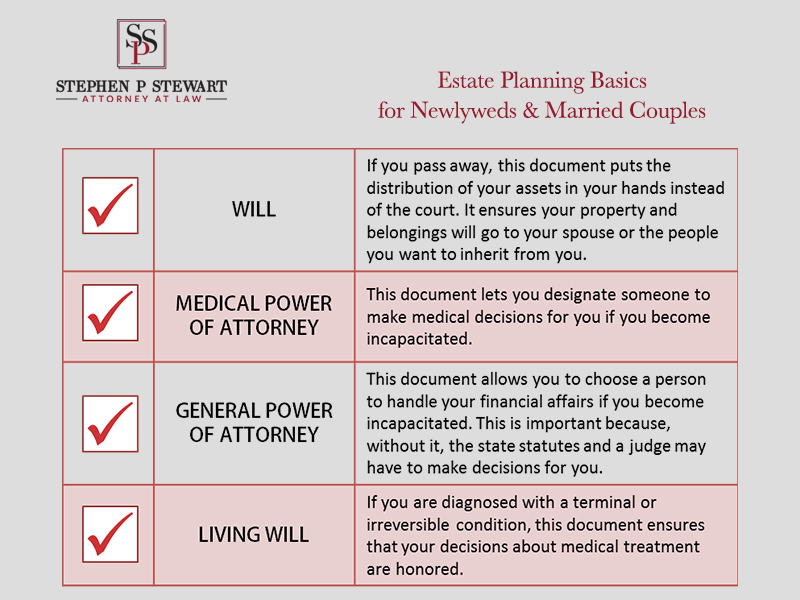

There are particular records you'll require as component of the estate planning process. Some of the most common ones consist of wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a myth that estate planning is just for high-net-worth people. However that's not true. In truth, estate preparation is a tool that everybody can utilize. Estate intending makes it much easier for individuals to identify their desires prior to and after they die. Unlike what many people believe, it extends past what to do with properties and liabilities.

The 45-Second Trick For Estate Planning Attorney

You need to start preparing for your estate as soon as you have any kind of quantifiable property base. It's a continuous procedure: as life progresses, your estate plan need to change to match your situations, in accordance with your brand-new goals. And maintain at it. Not doing your estate planning can trigger excessive financial problems to enjoyed ones.

Estate planning is frequently believed of as a tool for the rich. Estate planning is also a fantastic way for you to lay out strategies for the treatment of your minor kids and animals and to outline your wishes for your funeral and favorite charities.

Qualified applicants who pass the examination will certainly be formally licensed in August. If you're qualified to rest for the exam from a previous application, you may submit the brief application.

Report this page